Paycheck calculator with dependents

Use Withholding Calculator to help get right amount for 2019. Other income not from jobs year.

9 Best Free Paycheck Calculator Online Amazon Seller News Today

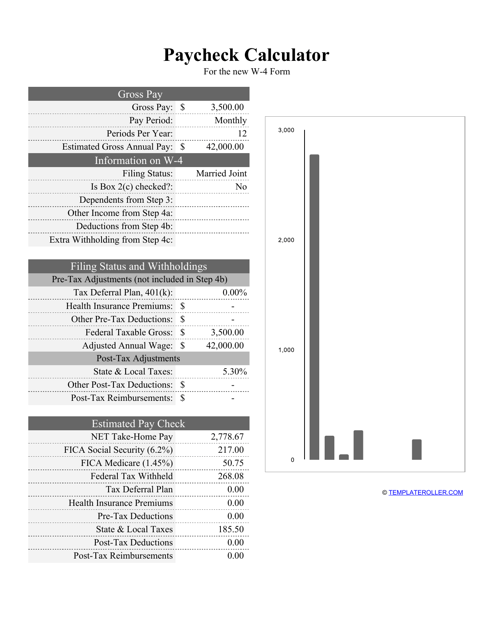

It can also be used to help fill steps 3 and 4 of a W-4 form.

. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Number of other dependents.

IR-2018-217 Get Ready for Taxes. Step 4 Tax liability. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. This number is the gross pay per pay period.

If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you.

IR-2019- 107 IRS continues campaign to encourage taxpayers to do a Paycheck Checkup. The more frequently you get paid the smaller each paycheck will be. Subtract any deductions and payroll taxes from the gross pay to get net pay.

This number is the gross pay per pay period. IR-2018-167 Taxpayers with children other dependents should check their withholding soon Tax Tips. Claiming dependents might affect your pay as well.

Using a paycheck calculator like ours will help you see how your paycheck changes when you withhold more or less money. Naturally the frequency of your pay will also affect the size of your paycheck. Interest dividends retirement income etc.

Federal Paycheck Calculator Calculate your take home pay after federal state local taxes. Claim Dependents W-4 Step 3 amount. 2021 2022 Paycheck and W-4 Check Calculator.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Heres how the new tax law revised family tax credits. The PaycheckCity salary calculator will do the calculating for you.

The PaycheckCity salary calculator will do the calculating for you. Dont want to calculate this by hand. Enter the total amount here qualifying childer under 17 times 2000 plus all other dependents times 500.

Dont want to calculate this by hand. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

Paycheck Calculator Salaried Employees Primepay

Paycheck Calculator Take Home Pay Calculator

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Pin On Profile

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

What Is Tax Debt How Can I Pay It Off Quickly

Paycheck Calculator Discount 51 Off Www Wtashows Com

Do You Need To File Taxes Money Skills Filing Taxes Tax Preparation Services

Caption Boxes For Photographic And Illustrated Characters Elearning Instructional Design Learning

Paycheck Calculator Online For Per Pay Period Create W 4

9 Best Free Paycheck Calculator Online Amazon Seller News Today

Pin On Calculator

California Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Pay Calculator With Taxes Deals 50 Off Www Wtashows Com

Free Online Paycheck Calculator Calculate Take Home Pay 2022